Deloitte Insights: 5 key trends affecting the oil and gas industry in 2024

According to Deloitte's 2024 oil and gas outlook, geopolitical uncertainty will continue to influence the oil and gas industry, while energy transition and harnessing the power of AI are the major trends affecting it. Read about the five key trends.

In Deloitte’s yearly oil and gas industry outlook, the global audit, consulting, and advisory giant points out five key trends and industry drivers that are expected to play an essential role in shaping the strategies and priorities of oil and gas companies in 2024:

- Energy transition: Allocating capital and effectively executing clean energy policies.

- Critical minerals: The green shift relies on some critical minerals (nickel, cobalt, lithium, graphite, and rare earth); securing a position in the supply chain is necessary to tackle perceived end-market risks.

- Global energy trade: Embracing the growing dynamism in energy trade and relationships.

- Technology adoption: Harnessing the power of generative AI for innovative solutions and new value creation. This requires controlling and accessing data from different sources.

- Downstream industry: Revamping the refining industry in alignment with evolving demand patterns.

At the same time, Deloitte remarks that the energy landscape continues to be impacted and potentially disrupted by four crucial factors:

- Geopolitical uncertainty: Evolving situations in Eastern Europe and the Middle East, and changing global trade patterns.

- Emergence of new technologies: The majority of clean energy technologies remain under development, and securing the supply chain is imperative for upcoming technologies.

- Macroeconomic environment: High inflation is increasing material and capital costs, and high interest rates are driving 10-year treasury yields to their highest levels since 2007.

- Policy and regulatory initiatives: 106 nations have targeted net-zero emissions by 2050. Since 2020, governments worldwide have allocated USD 1.34 trillion in clean energy.

Deloitte Research Center writes: “These disruptors can have a significant impact on demand and supply, as well as trade and investment within the crude oil and natural gas (O&G) industry.” Despite these disruptions, global oil demand remains on track to grow by 2.3 million barrels per day (mbpd) in 2023 and cross the 100 mbpd mark for the first time in history, according to the International Energy Agency (IEA).

Harnessing the power of generative AI

Deloitte Research Center identifies technology adoption (Artificial Intelligence—AI) as one of the five key trends impacting the oil and gas industry this year. Deloitte writes: “Generative AI presents opportunities for oil and gas companies in a wide range of areas, including reducing operational costs, improving process efficiencies, optimizing revenue generation, and accelerating prototyping and innovation.”

Underneath AI and Machine Learning (ML) lies data—lots and lots of data. To fully harness the power of AI, you need access to data regardless of whether the sources are data lakes, databases, applications, or others. You also need to control the quality of data.

Still, access to and control over data and (lack of) data quality are major pain points for many O&G companies. That’s why Cegal focuses on solutions and services that ensure access to data and provide better data quality. The Cegal Data Program identifies and fixes problems related to data management. With Cegal Cetegra, data and applications are made accessible for geoscientists, data managers, reservoir engineers, and others, no matter where they are or what device they use.

Read the article Uncover your subsurface project and data landscape to uncover meaningful transformation >

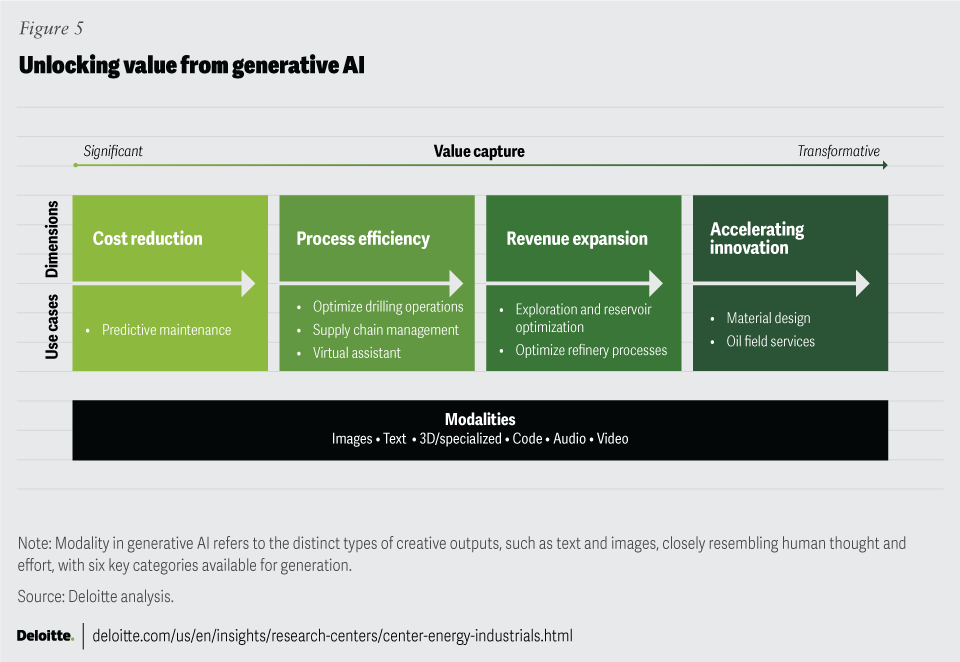

Deloitte emphasizes that the value of generative AI for the O&G industry can be categorized into four dimensions: immediate cost reduction, enhanced process efficiency, and the creation of new revenue streams, ultimately culminating in the acceleration of innovation-led change within the company (Figure 5).

- Cost reduction: Generative AI-driven solutions could aid O&G companies in cutting operational costs, especially in addressing challenges related to unplanned downtime.

- Process efficiency: Generative AI could enhance efficiency by integrating and analyzing diverse data sources. It can help proficiently process vast quantities of data, including geological and subsurface information such as seismic surveys, well logs, and historical drilling records, leading to optimized drilling processes.

- Revenue expansion: Generative AI can help pave the way for increased revenue generation. It can optimize the exploration of high-yield reserves and enhance recovery from the existing ones. In seismic data analysis, generative AI could generate missing or incomplete samples, refine interpretation, and elevate overall data quality. In reservoir characterization, highly detailed 3D models can be created that simulate reservoir behavior for recovery maximization.

- Accelerating innovation: Generative AI can help expedite the development of new solutions by enabling rapid testing of new ideas and concepts.

Photo: generated by using AI.